Title

Navigating Economic Challenges: Insights from April’s Credit Panel Event Discussions

Spring is a season of renewal, fresh perspectives, and strategic realignment — an apt time to explore the ever-evolving landscape of credit management.

Industry professionals gathered at PwC’s prestigious More offices for a sunny April afternoon dedicated to exploring the latest economic trends and equipping credit managers with the tools needed to make better decisions.

The latest Esker Credit Panel event brought economists, financial experts, and credit professionals together to discuss the challenges and opportunities shaping the credit management sector in 2025.

Understanding the Economic Landscape

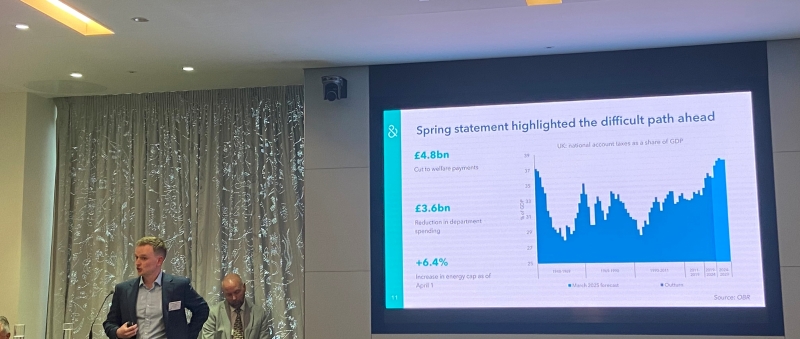

Proceedings kicked off with a comprehensive economic outlook by Dun & Bradstreet Senior Economist, John Payne, who provided a detailed analysis of the UK's fiscal forecast. He explored the impact of fluctuating interest rates, inflationary pressures, and shifts in global trade policies.

One of the most highly anticipated topics was the effect of the recently announced tariffs on global supply chains. Trade policy will increasingly influence B2B credit risk, creating new challenges for companies reliant on international suppliers. John emphasised that business agility and adapting to these policy changes will be key to distinguishing winners from losers.

Tackling Insolvency Trends

A major highlight of the event was the discussion on insolvency patterns, led by Lucy Fulmer, Head of PwC's Creditor Markets Team. With 2024 being one of the worst years on record for insolvency, the challenges look set to continue throughout 2025. Lucy stressed the importance of credit managers staying vigilant to early warning signs of distress such as missed reporting obligations, multiple changes in directorship, and order anomalies (sudden increase in quantity, or frequency of orders).

With certain sectors having notably higher risk, this session provided attendees with valuable insights to strengthen their credit portfolios and enhance their risk mitigation efforts.

Thought-Provoking Debate

The event concluded with an interactive Q&A panel discussion, facilitated by Luke Sculthorpe (Head of Strategic Relatinships, Chartered Institute of Credit Management), with contributions from Natascha Whitehead (Senior Business Director, Hays), Ray Massey (Director of Underwriting, Credit, Tokio Marine HCC), and Martyn Brooke (Credit Management Specialist, Esker).

The panel of specialists fielded questions on the evolving credit management labour market, credit data and insurance challenges, and the role of artificial intelligence in credit assessment.

Attendees were particularly interested in how AI-powered solutions can improve credit scoring accuracy, optimise portfolio management, and reduce manual workload. The panel discussed how AI-driven analytics can streamline decision-making, providing more predictive insights into credit risk.

With expert insights driving the lively debate, attendees came away with a deeper understanding of the challenges and opportunities driving the credit industry forward.

Looking Ahead

With economic uncertainty, insolvency risks, and AI-driven transformation shaping the future of credit management, continuous learning is essential. The panel events aim to ensure that credit professionals remain ahead of industry trends, ready to make informed decisions in an increasingly complex financial environment.

If you missed this April panel, keep an eye on the Esker event schedule for upcoming opportunities to stay on top of the latest industry trends and technology developments.

The future of credit management is evolving—be prepared to navigate it with confidence!

Get in touch if you'd like to learn how Esker can help. Or learn more about Esker Credit Management.