Title

Cash Application – The ‘Only Connect’ of the Order to Cash Cycle

Learn how Esker Cash Application can connect the dots to allocate cash and solve the missing parts of the cash application puzzle.

You might have seen my previous blog around one of my favourite old game shows, Supermarket Sweep, and commonalities between claims and deductions in the order-to-cash cycle.

It got me thinking about game/quiz shows and processes in order-to-cash. One such process, very close to my heart, is Cash Application.

There is surely only one quiz show that we can link here, and that’s Only Connect.

To my friends around the world, I’m sorry, as this may be lost on you. The show I’m referring to, is the popular BBC quiz show hosted by the poker playing, geek fantasy pin up, Victoria Coren Mitchel.

Only Connect is simply about ‘finding connections between seemingly unrelated clues.’

In theory, this should have nothing in common with the Cash Application process because it should be as simple as 1,2,3…

1. We receive a payment on the bank statement from a customer for an amount

2. We receive a remittance from the customer quoting this amount and listing invoices that make up that total

3. We match the payment to the remittance and invoices quoted to the invoices open on the customers Sales Ledger account.

It shouldn’t be as tricky as this Only Connect question….

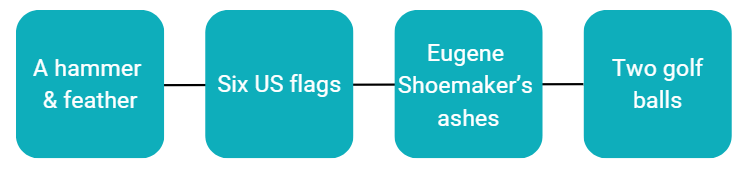

What do these 4 items have in common….

If you’re wondering – the answer is ‘Items left on the Moon’.

However, the perfect Cash Application process rarely exists. This is because bits of the puzzle are often missing:

- Payment information – payee name or reference number

- Missing remittance advices

- Missing invoices

- Customer errors (misquoted invoices, incorrect totals)

- Short payments

- Deductions / discounts

- Withholding taxes / Currency differences

This is when it becomes similar to a round of Only Connect. Trying to find the missing link in mountains of siloed data.

This is when a manual process breaks down, and the outcome of this is…. The dreaded, Un-allocated cash.

An incredibly wise person recently said to me that as a Credit Manager, your biggest enemy and concern should be un-allocated cash. If you have high levels of un-allocated cash, you don’t have a ledger. You just have a list of numbers.

The downstream effect of un-allocated cash is extremely painful…

- Incorrect balances on accounts

- Wasted time and effort chasing for payments that have already been paid

- Ineffective dunning processes

- Annoyed customers

- Potential fraud from laundered payments needing to be refunded

- Auditor pain

If this sounds familiar, then Esker has a solution. Esker Cash Application:

- Pulls all the pieces of siloed data together from multiple data sources

- Collects siloed information on the bank file, or within a remittance, from a customer portal or from your Open AR ledger.

- References its AI library of customer remittances to locate missing information

- Searches across millions of open items and calculates potential matches if no remittance is supplied

- Helps find a home for unallocated cash where humans can’t

It effectively connects the dots where you can’t. Just like those very tricky questions on Only Connect!

Watch this short video for more information, or feel free to contact me for a demo.