Title

Accounts Receivable Automation: Building a Business Case for Success!

Understanding how process automation works and the advantages it can create, leads to more effective persuasion and organisational-wide acceptance while ultimately delivering improved customer experience (CX) and greater value generation across the business.

Automated solutions have long been on the radar of anyone familiar with the mundane tasks and manual bottlenecks found within a traditional invoice-to-cash (I2C) cycle. It wasn’t until recently, however, that technologies for digital transformation have evolved from a pipedream to what they are today for many accounts receivable (AR) departments — an arguable necessity. But pursuing this type of initiative isn’t as easy as choosing a solution and hitting the ground running. Even with the staggering amount of external business challenges (inflation, economic instability, etc.) raising more awareness about the potential of AR automation, the biggest hurdle must be cleared — getting buy-in from multiple key stakeholders!

Why AR automation is worth fighting for

Executives have a broad range of projects and priorities competing for their attention. By crafting a strategic and well-thought-out business case, it will clear up any misconceptions about AR automation and increase the chances of convincing decision makers that:

- It’s more than a cost saver. Automation reduces AR-related expenses, for sure, but its true impact is far broader — enabling you to release cash faster and facilitate smarter growth strategies.

- It’s not a replacement. Good AR is not possible without humans. To that end, automation — even when powered by AI — is not meant to replace people but rather enhance their capabilities.

- It’s an ideal silo-breaker. AR doesn’t operate on an island. That’s why automation unites the people and processes that have a direct impact on CX, cashflow and working capital.

- It’s too important not to. At a time when uncertainty is rampant, flimsy excuses (“We’ve always done it this way!”) to not automate are no longer valid — the stakes are too high.

Processes primed for improvement

Credit management

Automated solutions help AR departments secure more revenue by optimising the entire credit approval and risk monitoring process. On the credit management side, this is done by empowering team members with digital tools designed to fix foundational issues like:

- Inability to properly secure customer credit terms

- Inaccurate risk assessment while supporting sales staff

- Poor compliance with credit policies

- Inadequate visibility over customer information

- Limited capacity to react to and/or anticipate changes in customer situations

Invoice delivery

By automating the delivery and archiving of customer invoices via any media (without sacrificing compliance or forcing customers to change their preferences), digital invoice delivery solutions create a value-added ripple effect, addressing common pains such as:

- Higher invoicing costs & error rates

- Lengthy cash collection delays

- No tracking of invoice delivery

- Customer hesitation to move to e-invoicing

- Difficulty ensuring compliance

- Complexities associated with the rise of AP portals

Payment processing

Lack of online payment capabilities throughout the I2C cycle (e.g., pre-order, at due date, collection process) makes it more difficult for customers to consistently make timely payments. Digital payment processing solutions increase your chances of getting paid thanks to self-service online payment options around the world from a secured customer portal that can be used for:

- Retrieving information from all sources & formats

- Managing exceptions

- Making adjustments to all accounts

- Performing fast allocation & reconciliation in the ERP to keep accounts clear

Cash application

Collecting payment is one thing. But trying to allocate cash in a timely and effective manner — while managing multiple payment sources and formats, not to mention the various levels of data — can be an entirely different struggle. Automated solutions remedy this by using a combination of AI-powered remittance management and auto-matching capabilities to take the unnecessary effort and errors out of reconciliation. From a single interface, AR teams can overcome common cash application difficulties involving:

- Retrieving information from all sources & formats

- Managing exceptions

- Making adjustments to all accounts

- Performing fast allocation & reconciliation in the ERP to keep accounts clear

Claims & deductions

Identifying deductions from payments or claims can also be a difficult proposition for AR teams operating in manual environments. Once again, applying automation is highly effective in speeding up and simplifying these types of critical processes. Through AI-driven data capture and electronic workflow capabilities, teams can avoid setbacks such as:

- Profit dilution

- Time-consuming investigations

- Lack of visibility & traceability

- Incorrect accounting

Collections management

In terms of coping with supply chain delays and other external disruptions, few strategies are more effective for a company than optimising cash collection. Automated solutions do just that by organising and enhancing collections with AI-assisted tools that free up AR team members and facilitate real-time insight into valuable metrics and even payment behaviour analysis. The end result is a process that sidesteps difficulties in:

- Following up with customers in a timely manner

- Keeping payment delays under control

- Maintaining compliance with credit policies & collections strategies

- Achieving visibility on collections performance & customers’ situations

- Nurturing customer relationships

Making your case: 3 reasons to transition to a digital future

From the perspective of key stakeholders and decision-makers, good project investments are the ones that benefit the entire organisation — not just a handful of I2C processes. They are acutely aware that the choices being made now regarding digital transformation will have ramifications for decades to come. If your business case isn’t “speaking the language” of those most impacted, there’s a higher chance it will fall on deaf ears. So, what are the three most strategic reasons to pursue AR automation in order win hearts and minds and ensure your project’s success? Let’s explore...

Reason No. 1: It creates more fulfilled, proactive & impactful AR employees

Although manual I2C activities can seem benign, cumulatively, they play a huge role in saddling AR teams with errors, slowdowns and productivity losses — ultimately hurting the financial health of the company. In the course of building your business case, it will be beneficial to call out exactly how automation produces end-to-end efficiencies, who benefits from them, and how those benefits translate to “big picture” successes. Empowerment through AI assistance, the most compelling case for automation to AR teams lies in the potential of the technology driving it — artificial intelligence (AI). In addition to Robotic Process Automation (RPA) and Optical Character Recognition (OCR), digital solutions often integrate AI technologies such as machine learning, deep learning and Natural Language Processing (NLP) into their workflows, acting as a digital assistant to streamline daily activities, free up time and enhance visibility.

Reason No. 2: It helps the Office of the CFO be the best version of itself

To say that the Office of the CFO is an integral part of an organisation almost feels inadequate. The Office of the CFO must balance traditional finance responsibilities with driving value and strategy across the entire enterprise. Moreover, the high wire on which this balancing act takes place is an environment rife with lingering risks, looming uncertainty and a blink-or-you’ll-miss-it acceleration of digital technologies. With such a broad and diverse set of responsibilities, the Office of the CFO seeks the type of digital investment that will not only deliver immediate benefits, but also scale with the pace of change. Automated AR solutions suit this perfectly — helping the Office of the CFO be the best version of itself by optimising the issues and functions it cares about most, and having a positive impact on:

- Working capital improvements

- Talent retention

- Visibility and cashflow management

- Global compliance and risk mitigation

- Smarter growth and business resiliency

- Mobile capabilities

- Customer experience

Reason No. 3: Its benefits span far beyond the AR department

In the course of building your business case, it will be beneficial to call out exactly how automation produces end-to-end efficiencies, who benefits from them, and how those benefits translate to “big picture” successes.

- Sales: If AR processes are slow, inefficient and unresponsive, it can make it very difficult for Sales staff to maintain customer loyalty so that customers continue working with them in the future. Getting a department as essential as Sales to agree on the value of the project goes a long way to securing approval, so it’s a good idea to include some of the benefits that AR automation has for Sales in your business case.

- Accounts Payable: Accounts payable (AP) and AR are essentially two sides of the same coin: How much you pay and how much you owe are equally important to company credit and overall financial health. Mismanagement of either can adversely affect a company’s credit and decisions related to cash position. And while the two departments don’t necessarily have a 1-to-1 connection, an optimised AR process is equally as important as an optimised AP process in the eyes of some key stakeholders — namely, the Office of the CFO.

- Customer Service: It’s no secret that optimised customer service processes positively benefit the AR team. The faster orders can be processed, enquiries can be answered and claims can be managed, the better it is for downstream I2C fluidity and company cashflow. Conversely, excellence on the AR side can also have positive ramifications for the Customer Service team.

- IT: Undoubtedly, the IT department has its own list of priorities and apprehensions for any new solution that’s implemented within the organisation. If they are not consulted or their needs are left unaddressed, your AR initiative will fail to gain the traction it needs to move forward. The last thing any IT leader or top decision maker wants is a new solution disrupting the existing infrastructure in any way. Fortunately, best-in-class automation solutions can accommodate any situation by seamlessly connecting AR to your existing business environment by integrating with any ERP or business application.

Completing your business case checklist

Define your objectives

This can include what type of solution you want to pursue, if you want to automate beyond AR, or listing the concrete issues you wish to address. Be clear and concise and communicate without conjecture or jargon.

Back it up with data

You can explain why an automated solution is good for business all day, but upper management is going to need measurable data to justify their decision. An effective strategy is to compare your current AR KPIs to “best in class” processes.

Be predictive

Describe your vision for the future by providing context into what your department could be achieving with automation. This could be everything from how much faster you’ll be processing orders in three months to how your KPIs will improve in three years.

Consult with stakeholders

Obviously, support from the executive decision makers is the end goal, but time consulting with people and departments directly impacted must not be neglected. This includes AR clerks, Sales staff, IT and more.

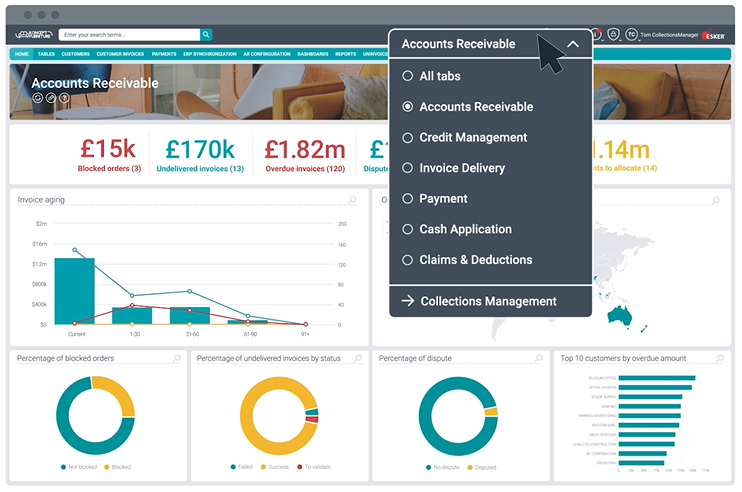

Rethink receivables management

Esker’s Accounts Receivable solution suite is ideal for AR leaders wanting to accelerate cash collection and revenue recognition. Powered by Esker Synergy AI, it can be easily scaled to optimise and connect each step of the invoice-to-cash (I2C) process — improving overall efficiency, visibility and collaboration. The result is not only reduced DSO, but an enhanced experience for every user. Get in touch for a demo today!