ACCOUNTS RECEIVABLE AUTOMATION

ACCOUNTS RECEIVABLE AUTOMATION

A Global Solution Suite to Optimise the Invoice-to-Cash Process

Esker Named a Challenger in the

Esker Named a Challenger in the

Gartner® Magic Quadrant™ for integrated

Invoice-to-Cash Applications

Esker are delighted to be a finalist

Esker are delighted to be a finalist

in the Supplier of the Year and Credit and

Collections Fintech Supplier categories

at the British Credit Awards 2023

RETHINK RECEIVABLES MANAGEMENT

Supported by AI technology, Esker’s Accounts Receivable software solution removes the obstacles preventing timely cash collection while providing finance leaders with the visibility they need to monitor their organisation’s cashflow and achieve positive-sum growth. From credit management to collections and everything in between, Esker automates the areas of AR that matter most to your business.

- LOWER CREDIT RISKS

thanks to analytics that help you make the best credit decision possible.

- OPTIMISE AR INVOICING

by delivering timely invoices aligned with customer preferences & legalities.

- ACCELERATE PAYMENT

by offering a wide range of self-service online payment capabilities.

- ALLOCATE CASH FASTER

by taking the effort & errors out of the process — from remittance to reconciliation.

- RESOLVE DISPUTES QUICKLY

through the use of intelligent AI-driven claims & deductions capabilities.

- SIMPLIFY COLLECTIONS

& reduce DSO by enhancing your strategy with predictions & risk analysis.

KEEP YOUR CREDIT RISK UNDER CONTROL

Trust alone is not enough — businesses must keep a watchful eye on their credit risk. From customer onboarding to managing business relationships, Esker's comprehensive Credit Management solution streamlines the credit approval and risk monitoring process, helping businesses secure sales revenue.

DELIVER THE PERFECT INVOICE.

Esker defines a perfect invoice as one that’s compliant with the PO, customers’ format requirements, delivery method and local regulations. How do we ensure invoices won’t get rejected? By offering 100% automated invoice delivery via any media or to portals and full compliance in 60+ countries around the world.

- Block url new window:off

SIMPLIFY PAYMENT FOR CUSTOMERS

Payment doesn’t have to be complicated. That’s why Esker offers the most popular payment methods including: Card payment (e.g., Visa, Mastercard, American Express, etc.) and direct debit (e.g., ACH, SEPA, BACS, EFT, etc.) so your customers never have an excuse to not pay you. Esker also integrates with local and global payment processors like Stripe to offer you and your customers the best possible experience.

- Block url new window:off

ANALYST ACCOLADES

Esker’s Accounts Receivable solution suite has been recognised by multiple leading analyst firms.

Esker Named a Challenger in the Gartner® Magic Quadrant™ for Integrated Invoice-to-Cash Applications

Esker Named Leader In the IDC MarketScape for Accounts Receivable 2021

Esker Listed in the Forrester Accounts Receivable Invoice Automation Landscape, Q1 2023

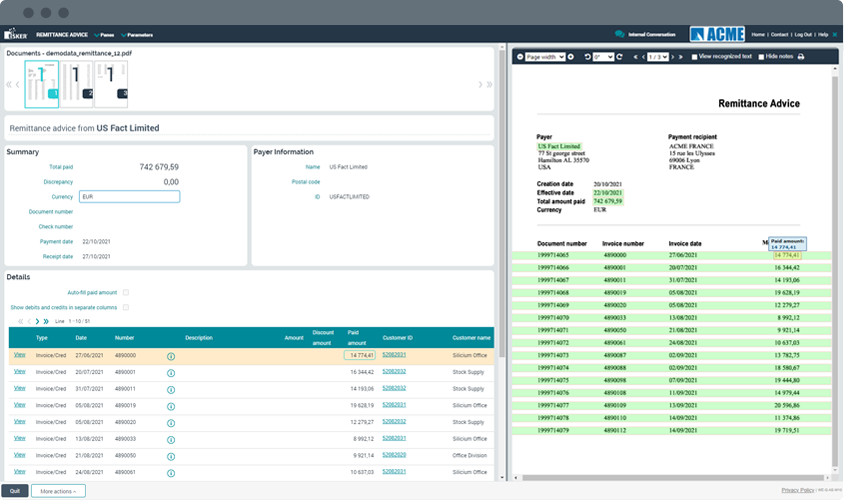

ACCELERATE CASH ALLOCATION

Why have a top-notch collections tool if payments can’t even get allocated in a timely manner? Esker’s Cash Application solution, supported by AI-recognition technology, accelerates the cash allocation process, ensuring your receivables are up to date and your AR team is always working efficiently and strategically.

- Block url new window:off

ENHANCE YOUR CLAIMS & DEDUCTIONS MANAGEMENT

Put an end to the countless hours spent solving customer claims. Esker’s Claims & Deductions solution manages both customer claims associated to product issues and customer financial deductions. AI technology centralises information and facilitates cross-department collaboration to help you work transparently and efficiently.

UPGRADE YOUR COLLECTIONS PROCESS

Collecting cash has never been easier. Esker's Collections Management solution automates what can be automated according to your credit policy (e.g., delivery of reminders, dunning letters and reports) and provides your collections team with the right tools to collaborate on invoice-related issues. AI technology prioritises collection calls to help you efficiently manage your credit risk and reduce bad debt.

WHY MANAGE YOUR AR PROCESSES WITH ESKER?

- Instant visibility on all customer accounts, invoice statuses, actions & performance

- Faster invoice related issues resolution (e.g., dispute, deductions, etc.)

- Easier onboarding & fewer IT resource requirements

- Guaranteed compliance no matter what your location

- Lower DSO & optimised working capital

- Improved team productivity & morale

- Block url new window:off

See what our customers say on Gartner Peer Insights

Trending content

Our partners

- Coming Soon

Ask us anything

Esker experts are always here to answer any question or provide more info.